Indonesia strives to challenge Singapore’s dominance in the region with a number of own port projects, aiming to become a new global transhipment hub on China’s maritime Silk Road, writes Nikkei Asian Review.

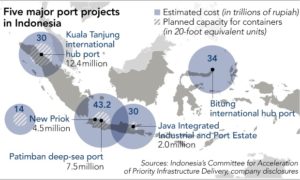

After taking office in October 2014, Indonesian President Joko Widodo endorsed the five-year plan worth 700 trillion rupiah (USD 50.6 bln) to develop the maritime sector. This included 243 trillion rupiah for developing 24 “strategic ports.” Slow at the beginning, the infrastructure development began to gather pace last year.

One of the ambitious projects is the Java Integrated Industrial and Ports Estate (JIIPE) – an immense industrial centre on a total area of 3,000 hectares, which would also include a deep-sea port and a residential estate. Strategically located on the eastern edge of Java, it is designed to become a trading hub and manufacturing center for Indonesia and Asia Pacific.

The JIIPE complex is developed by the state-owned port operator Pelindo III and the private partner AKR Corporindo and is due to be completed by 2030 to accommodate nearly 200 companies.

“By being integrated with a deep-sea port, this park will have direct access to domestic and international markets,” Joko Widodo said at the opening ceremony for the first phase of JIIPE in March.

The port will be constructed on a plot of 400 ha in Madura Strait, will have a total berth length of 6,200m with a draft of 16m to cater for vessels up to 100,000 DWT and to handle all types of cargo: from dry bulk, cars and container to oil and LNG. It is expected to reduce the workload at Tanjung Perak, Indonesia’s second-busiest port and the main gateway to the nation’s eastern provinces.

“At Tanjung Perak, ships often have to wait for a week outside [the port] before docking. We should have [developed the new port] three or five years ago”, a director of the JIIPE project said in May.

Other projects include the expansion of Tanjung Priok, the country’s busiest port in Jakarta; Kuala Tanjung Port at North Sumatra that will increase the container capacity. Port projects in remote cities like Makassar and Sorong are meant to reduce logistics costs, which today run to the equivalent of 24% of Indonesia’s GDP, that is significantly higher than in most countries in the region.

Other projects include the expansion of Tanjung Priok, the country’s busiest port in Jakarta; Kuala Tanjung Port at North Sumatra that will increase the container capacity. Port projects in remote cities like Makassar and Sorong are meant to reduce logistics costs, which today run to the equivalent of 24% of Indonesia’s GDP, that is significantly higher than in most countries in the region.

Indonesia, with its 17,000 islands has more than 1,200 ports but many of them are outdated and need refurbishing. In a recent study of 18 Indonesian ports, the World Bank highlights a “critical infrastructure gap” and writes: “The quality of ports’ infrastructure across the country is a weak factor in the overall country’s competitiveness.”

But the government can cover only a third of the 4,800 trillion rupiah (USD 348 bln) required for the port infrastructure development in the 2015-2019 period and therefore actively seeks investors worldwide. And not without success.

The Port of Rotterdam Authority provided consulting to Pelindo I on the Phase 1 development of Kuala Tanjung and is reportedly planning to invest in the next phase. The Japanese government signed a JPY 118.9 bln (USD 1bln) loan in November 2017 for the construction of the Patimban deep-sea port. Singapore’s port operator PSA International has been involved in one project and is said to may soon join another.

Apart from that, President Joko Widodo anchors big hopes on China’s OBOR initiative believing his maritime vision can complement it. And indeed, Beijing expressed some interest in port investment: Ningbo Zhoushan Port and China Communications Construction Engineering Indonesia have signed memorandums of understanding with Indonesian port operators to jointly develop New Priok and Kendal International Port, respectively. However, no actual investments have been made so far. And some analysts suggest that Indonesia is not a priority for China in its geopolitical plans.